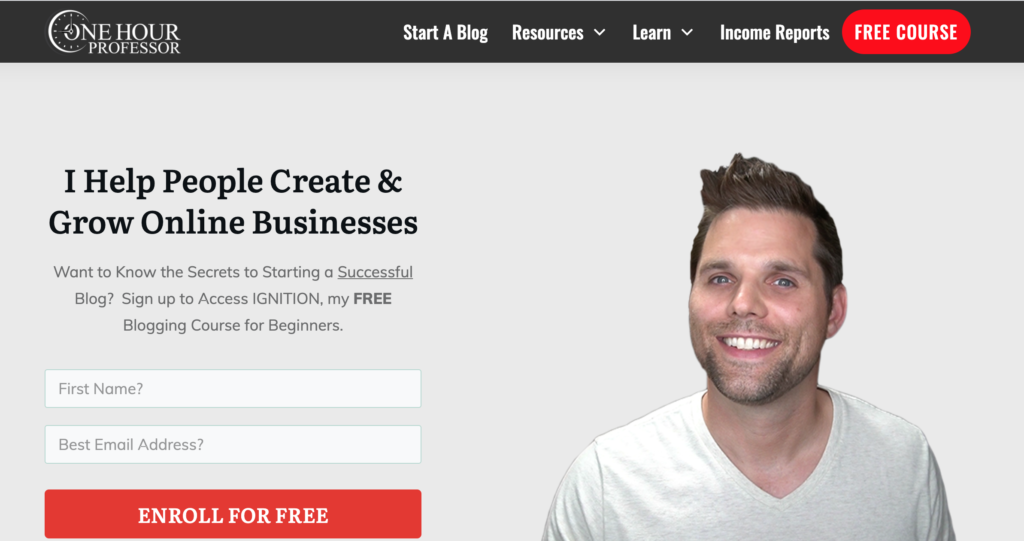

At the OneHourProfessor, Ron Stefanski has grown a million-dollar media business while helping thousands of others achieve success with their own businesses. He knows a lot about how to start a lifestyle blog, create a business, and make it grow.

Along with the blog, there is also a dedicated What Emma Did Boutique, offering girls a place to shop stylish dresses and outfits.

Our motto is to Love The Life You’re Living, with all that comes with it, good, bad and ugly.

Practicing self-love and being comfortable in your own skin is an everyday activity. Twitter, Facebook , Instagram and YouTube

So hold on tight we’re going on an adventure!

Her blog covers lifestyle, beauty and the student experience. Everything is honest, down to Earth and based on her own experiences. https://wordofrachel.com/

Follow her through her health issues, loves, trials and tribulations and keep an eye out for all the cute pet photos!

A family and lifestyle blog featuring everything from life with a toddler, working from home, fashion, food, travel and interiors.

Jenni lives in Lancashire with her partner and son, born Feb 2015 Facebook , Twitter , Instagram

It aims to show that there is a bigger world online for Cebu in terms of food, culture, destination and people.

His blog aims to provide useful and interesting content for it’s readers. Topics covered include Parenting (obviously), Family, Home & Garden, Technology, Finances, Health and generally anything Tom enjoys writing about!

Her motto is Cook • Create • Celebrate! Join her as she shares delicious recipes and creative ideas for seasonal events, parties, travel, and lifestyle. Michelle thinks up the ideas so you don’t have to!

Lisa also welcomes guest posts on “Cyber Geek Girl”, interviews and collaborations with relevant brands.

Discover unique tourist spots in each city and explore them with confidence.

I’m a lifestyle and parenting blogger from Northern Ireland, blogging about lifestyle with a vintage twist, parenting teenagers, as well as hints and tips to help other bloggers.

My background is in social policy having worked at government level for over 10 years. I am a part time blogger since 2016 and have worked with brands such as Boots, Tala Bakeware, River Island to name but a few.

Some of my posts have also been featured in the Mirror Group papers.

There are also personal posts made regarding the publication of her recent book Rats, Mice and Other Things You Can’t Take to the Bank, an Inspirational Collection of Essays From Humorous to Simply Human.

This is the site to follow to read inspirational true stories about human kind, often with a witty twist.

She spends her days dressing men and women all over the globe and is nicknamed a “hippie in heels” for her commitment to the greater good.

Contributing to Harpers Bazaar, Bon Appetit, W Magazine, MindBodyGreen, PopSugar, Metro NY, StyleCaster, BuzzFeed, Cosmopolitan, and more.

Natty Style is where I share my tips and inspiration for living a naturally natty lifestyle at home and around the world. www.nataliedecleve.com

www.lyliarose.com

Come and check out my crazy world. Www.missljbeauty.com

Twitter – https://twitter.com/

We have also a strong emphasis on green living, outdoors and nature running throughout the blog.

Since then, it has grown to one of the UK’s leading interior design blogs, whilst also covering various lifestyle topics such as food, fashion, beauty and travel.

Where menswear meets go-go dancing. Where the American Flag is held by bunnies in underwear.

Where life is unexpected but always colorful.

If you’re looking for the best local places to eat on a trip, then the Traveleaters can guide the way.

Will Fly for Food

www.willflyforfood.net

Covering the best of what London has to offer, from the hottest new Instagram spots to the best new restaurants.

The latest fashion, beauty and home interior trends and travel inspiration.

Based in Manchester, UK Anoushka has her finger on the pulse of the city, whilst sharing her love of makeup, fashion and food.

Features cover the latest trends, real homes, ‘get the look’ and travel.

There is also an online shop and subscriptions pages for Warehouse Home magazine and the Warehouse Home book.

She finds the quirky, off the beaten trail things to do and places to eat to save you the bother!

With a real home, her makeovers are achievable and her photography and thoughts on her life authentic.

Travel is her passion, as she travelled the globe with brands such as Coca Cola, Marker Warner and James Villas.

I write about gardening, interiors, outdoor family fun, family crafts and days out.

Growing Family is a Vuelio Top 10 Gardening Blog. https://growingfamily.co.uk

Fall in love with your home again and make your life run how you want it to – with ease!

We cover all aspects of parenting, teenagers to newborn and we host other mums stories.

She writes about her personal experiences, as well as giving useful tips to students on how to get the most out of their experience.

I blog about travel, days out, home interiors and also share recipes.

Expect the latest in food trends and restaurants, travel tips and wanderlists, and lifestyle posts about London, life and love.

The blog features all the beautiful small or bigger things that make life exciting and give joy; from travelling and shopping to food and wellness.

Lucy is a former charity fundraiser, wife and mum to two rainbow babies.

She writes honestly about recurrent miscarriage, mental health and finding happiness in the little things in life.

Purveyors of vintage homewares, décor & lifestyle.

The blog overs topics such as travel, food, fashion and blogging and career tips.

Writer Annie is a self confessed adventure seeker, who covers a selection of topics but mainly focuses on fitness, travel and lifestyle.

Shortlisted in the UK Blog Awards for 3 years running, but finally picking up lifestyle blogger of the year with myProtein.

If you are looking for the ultimate active lifestyle blog this is the one to read.

I like to share my outfits, recipes, diet and fitness tips and anything else that happens along the way.

I also run 3 blog hops a week to help other bloggers share their posts.

The site also features global charitable causes, alongside offering advice on places to see and things to eat on multiple continents.

She also manages the East Midlands Blogger Network.

Emmie is based in Leicester where she lives with her Northern Irish boyfriend. www.carpediememmie.co.uk

Have weird feet. A 20-something Marketing Professional, freshly graduated (for the second time), this Blog is my Personal Development Journey.

I explore topics such as self-love, empowerment and happiness. I intend through these musings, to explore and ponder some of life’s difficult questions.

I hope that in reading you can find some resonance, interest and amusement… …or you may just decide I’m as weird as my feet. Follow the journey at www.rosiehawkins.co.uk.

This motivated me to complete a degree in Psychology 16 years ago. Soon afterwards, I qualified as a Life Coach and worked with people who felt “stuck” enabling them to set and achieve goals and make huge, positive life changes .

Hello there! I’m Emma and at the time of penning this little autobiographical blurb (that’s what they call it right?), I’m a thirty-something blogger based in West Yorkshire with a massive ASOS addiction and a love of lycra and adventure.

Although HarmonyBlaze may have purely started off as a pseudonym that gave me the confidence to open up online, it has now become a big part of who I am as a person. Oh and I also won the 2017 BloggersBlogAward for Best Fitness Blog!

The website motto is, “Enjoy your body, use it every way you can. Don’t be afraid of it or what people think of it”

Haley focuses on her real life experiences to offer support and guidance to others who are struggling with self love and self acceptance and is also very active on Instagram https://www.haleyryan.co.uk

Featuring woodland walks, travel, outdoor style, horses and some cosier elements such as book reviews and tips on how to slow down. If you’re looking for a blog that will encourage you to experience and appreciate the outdoors in an entirely new way, then you need to look no further.

www.sweetserendipityblog.co.uk

The blog has a fun, relaxed tone whilst keeping a honest laid back view on the beauty industry. You’ll also find regular posts on advice for daily problems like stress and lack of motivation whilst keeping life fun.